During the last decade, Tesla, Inc. (Nasdaq: TSLA) has been the clear leader in the rapidly growing electric vehicle (EV) industry and has reported a massive increase in the number of cars it sells per year.

Tesla CEO Elon Musk has a cult following and we believe he will be best known for creating businesses which are focused on increasing the amount of clean energy and helping the world (SpaceX, Tesla, and the Boring Company).

The success of Tesla in the EV market has been a catalyst for companies that are levered to some aspect of the industry. Due to Tesla’s impact on the EV market, we have been focused on identifying businesses that should be beneficiaries of the rising demand.

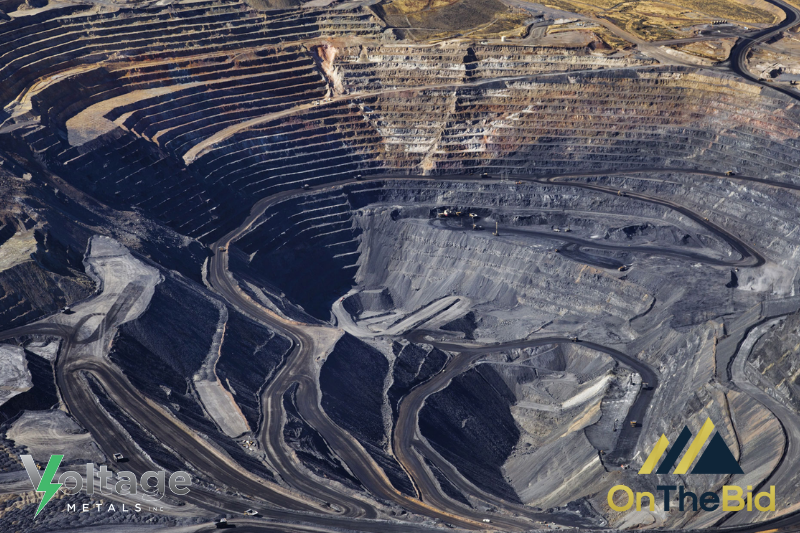

Voltage Metals Corp. (CSE:VOLT) is an early stage mineral exploration company which we identified as a potential beneficiary of the rising demand for EVs in major markets across the globe. The company is primarily focused on mining nickel, cobalt, chromium and other minerals that are required for the production of batteries for the EV market.

During the last decade, there has been a sharp increase in demand for metals that are used in batteries for EVs which has created a greater need for the supply of them. We are of the opinion that the supply-demand dynamic has been the primary catalyst behind the rapid increase in the number of exploration projects for metals that are used in EVs.

A key theme of 2021 was environmental, social and corporate governance, and we expect the theme to continue to gain traction in 2022 and beyond. A core pillar of the ESG market is related to global initiatives that are focused on reducing the amount of greenhouse gas and carbon emissions. Several major global economies have reported plans to gradually phase out gasoline-powered vehicles and consider this to be an attractive aspect of the ESG theme.

A Diversified Growth and Execution Story

Voltage Metals is an exploration company that is developing a large-scale project in Northern Ontario and we are favorable on the growth prospects that are associated with it. The company owns property that is located in a region which has multi-element sulfide mineralization across several widths and trends towards a large magnetic feature. Some of the metals that have been identified in the zone are nickel, copper, cobalt, gold, platinum, and palladium, and we are bullish on this aspect of the project.

We believe Voltage has de-risked the opportunity by using data from a geophysical survey to plan its follow-up strategy for mapping, soil sampling, rock sampling, trenching, and drilling programs. The survey collected both magnetic and time-domain electromagnetic data and specifically targeted zones that could have a substantial amount of sulfide mineralization.

Currently, Voltage is working on several projects in Canada (Ontario and Newfoundland) and we have highlighted them below:

- Wheeler – This is the only project in Newfoundland and is an early-stage nickel, copper, and chromium opportunity. The project covers almost 20,000 hectares in Southwestern Newfoundland and Labrador and consists of nine mineral claims.

- St. Laurent – The property is strategically located proximal to active gold operations and advanced nickel-cobalt projects

- Jerry Lake – The land is located in an unexplored region that is very comparable to the St. Laurent region. We believe the project could be a major catalyst if positive data is reported

- Montcalm – Like the St. Laurent property, the project is located near a mine that was previously producing nickel, copper, and cobalt

- Gambler – The project is located adjacent to Montcalm and covers most of the unexplored Montcalm Gabbro Complex

- Nova – The property is located southwest of the Montcalm mine which has a proven track record of finding valuable resources

Commences Drill Program at the St. Laurent Project

Last week, Voltage commenced a diamond drill exploration program at its St. Laurent Nickel-Copper-Cobalt project and we consider this to be an important step forward for the business. We expect the drilling results to provide important information about the geological characteristics that were previously identified in a diamond drilling program 2008.

Airborne geophysical surveys took place after the drilling projects were completed and the property was defined by a strong electromagnetic (EM) anomaly which has an associated bullseye magnetic response. These factors are known to occur when there is a mineralized zone and we believe the data de-risks the project.

Voltage’s management team has developed a multi-phased mining program that consists of approx. 3,000 meters of drilling. As part of the program, the company will conduct downhole geophysical surveys to define deeper conductive targets which will be tested in the later phases of the program.

We classify the St. Laurent magmatic system as an exciting exploration target due to the high dollar value that is associated with the type and the amount of minerals that can be extracted from it. Based on previous drilling data and the airborne survey, the management team identified anomalies that extend along an 800 meter corridor which allows Voltage to focus its drilling activities on a region that is considered to be the most prospective in the area.

The primary focus of the exploration are large-scale sulphides and high-grade nickel. The project will take previous drilling data into account and will also be focused on previously identified wide, low grade nickel intersections. Based on rising metal prices, we believe Voltage is executing on a strategy that could create the most value for shareholders and are bullish on the potential upside that is associated with the low-grade nickel intersections.

We believe the project could prove to be a major value creator for Voltage and expect positive data to be a potential catalyst for it. Based on the previous drilling results from shallow areas on the project, we expect the company to find high-value mineralized sections and consider this to be an underappreciated aspect of the story.

A Business with Catalysts for Growth

Out of the projects that Voltage is focused on, we are especially excited about the opportunity on the Wheeler Property. In 1962, the Geological Survey of Canada conducted a mapping program which found layered magmatic sulfide occurrences and multiple chromite-rich lenses near the southern part of the property. We are bullish on the findings and believe it de-risks the opportunity for Voltage and consider the project to be a significant potential growth catalyst.

We consider the geographic location of the property to be significant especially after a property that is located next to Wheeler reported major findings from a drilling program. The neighbor, YORK Harbor (YORK), has a proven track record of success in the region and we consider this to be important for Voltage.

During the last year, Voltage has raised capital and strengthened its balance sheet. We believe the business model has been de-risked and are bullish on the potential value that is associated with the projects it owns. We are favorable on the leverage to a project in Newfoundland since the province is a mining-friendly jurisdiction which has made it a hotbed for exploration projects.

Going forward, Voltage said that it plans to use capital on hand to advance its 2022 exploration programs and we are favorable on the risk-reward profile that is associated with its projects. We believe the geographic diversity of the projects will support the growth of the business and our readers should be aware of this.

If you are interested in learning more about Voltage Metals, please send an email to support@onthebids.com with the subject “Voltage Metals” to be added to our distribution list.

.

.

.

.

.

.

.

.Pursuant to an agreement between StoneBridge Partners LLC and Voltage Metals Inc. we have been hired for a period of 180 days beginning April 11, 2022 and ending June 11, 2022 to publicly disseminate information about (VOLT) including on the Website and other media including Facebook and Twitter. We are being paid $2,000 per month for a period of 6 months. We own zero shares of (VOLT), which we purchased in the open market. We plan to sell the “ZERO” shares of (VOLT) that we hold during the time the Website and/or Facebook and Twitter Information recommends that investors or visitors to the website purchase without further notice to you. We may buy or sell additional shares of (VOLT) in the open market at any time, including before, during or after the Website and Information, provide public dissemination of favorable Information.